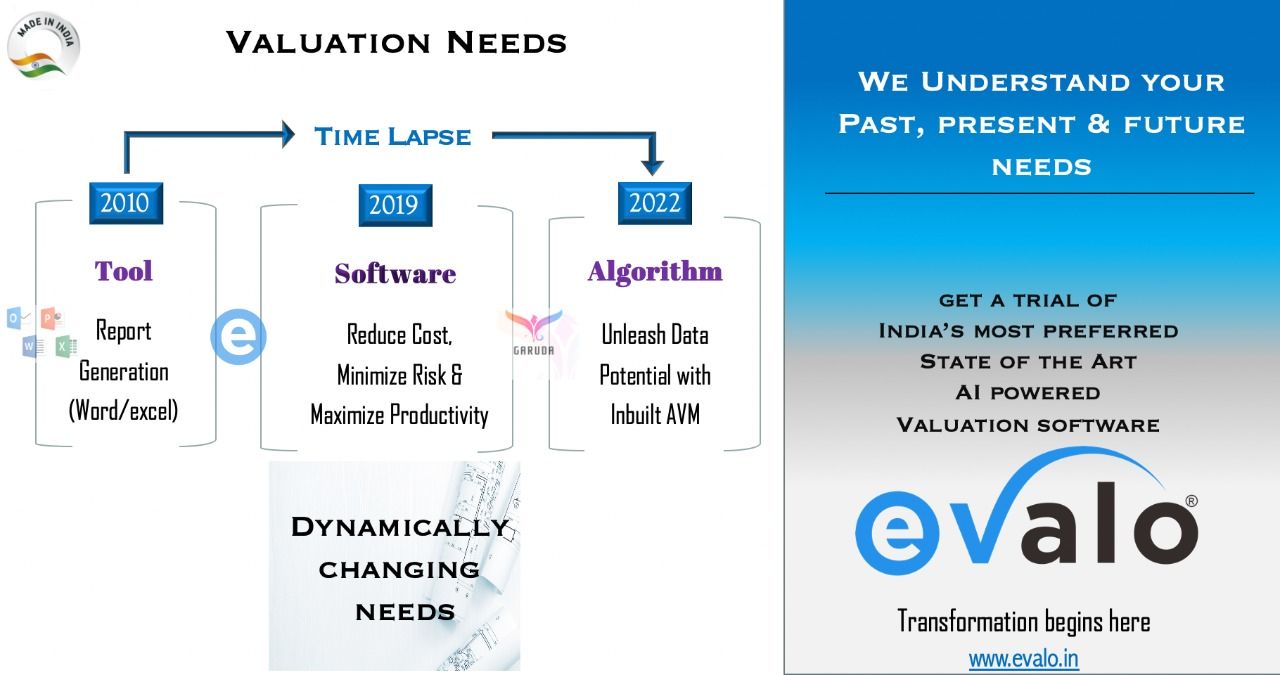

Unleash Your Data Monetization Potential

The world has surplus data. The content you read, the videos you watch, the updates you post, and the products you buy.

Similarly, Valuation firms are collecting a humongous amount of data and stored. But for most valuation firms, this data sits as paper Google Drives or Hard drives, never to be used. The good news is, you can use the data for your business' growth to make better decisions and growth.

What is data-driven decision-making?

Instead of going with a decision you think is best, data-driven decision-making is a strategy that uses data to aid in valuation decisions.

How can you benefit from data-driven decision-making?

In Valuation, there's always an element of risk, but data-driven decisions make you less vulnerable to risky decisions going wrong.

Use more of what worked (Historical Data) and less of what may or may not work – all based on the data you have collected to make qualitative valuation decisions.

Using data-based decisions, firms have experienced a profit increase of 8–10% and a 10% reduction in overall cost.

For what decisions can I use data?

Now you know how you can benefit from data-driven decision-making, the next step is to identify how your firm can use data to make decisions for how to grow your business.

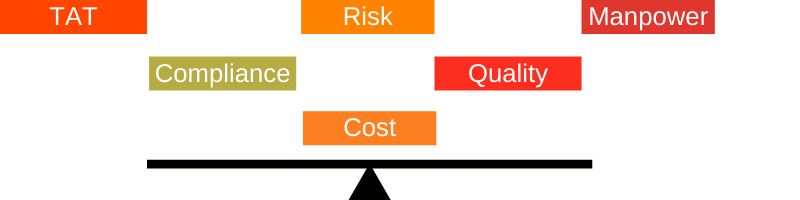

You can use data to derive a balance:

Now imagine taking a data-driven approach for every resource in your firm, and it's easy to see why companies that use data-driven decision-making are a lot more successful.

1. Plan your strategy

You've found the goal you want to improve and analyze the data to decide whether you're going ahead with the valuation finalization.

Next, you'll need to create a plan of action to put your decision into practice.

2. Measure success and repeat

You made your valuation decision based on your past data, and the results are in – well done! But that doesn't mean your decision-making process is over. Look at the data you originally collected and, based on your initial decision, if your decision was successful, congratulations!

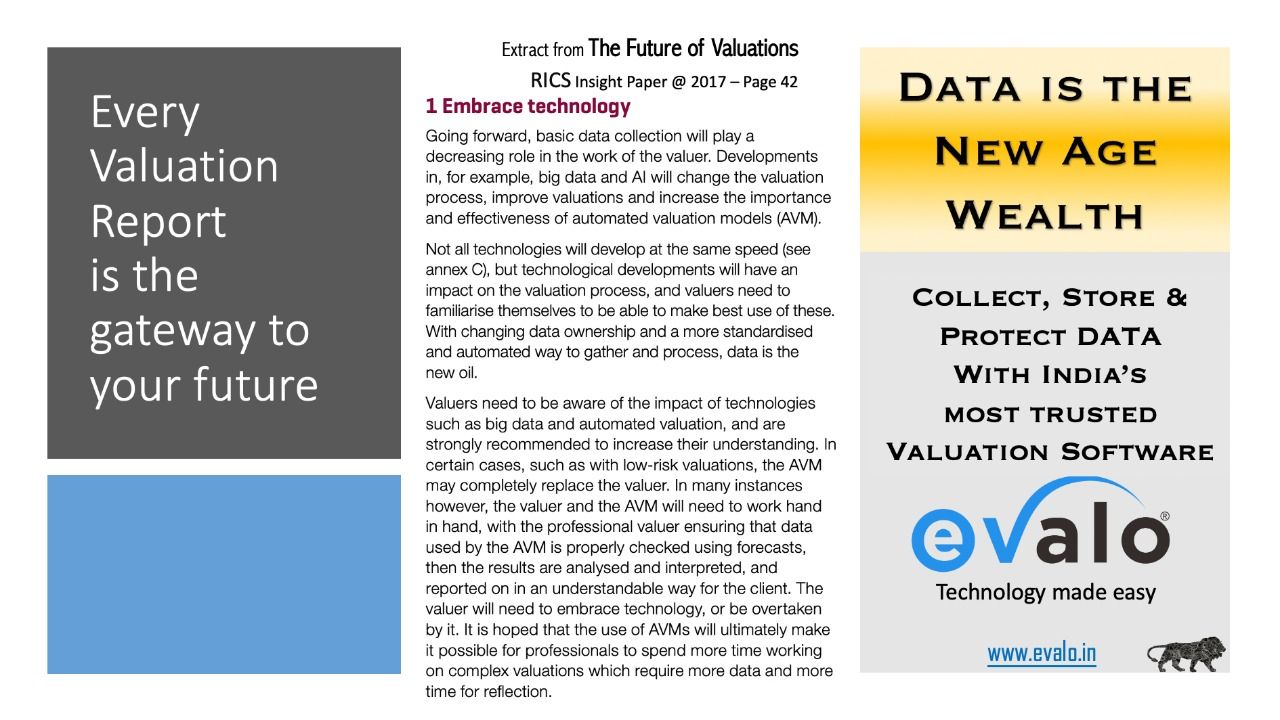

3. Own your Data

The information gathered and the reports generated by you shall remain solely within your secured data storage systems and avoid 3rd party data monetizers. Store the data and protect it for effectively monetizing in the future for valuation decisions, price trend analysis and comparables.

Create a system that can aid your team to repeat the same with little intervention from your side.

Conclusion

There's no doubt that data is a valuable tool for any Valuations. Firms that use data at the core of their decision-making reduce costs and increase profit.

Suppose you can use data to prove that your decisions are likely to impact business growth positively. In that case, it's worth the time to analyze data in a system, which appreciates your data privacy & proprietary ownership. Data is the new age wealth. Secure your data to monetize it in the future decisions and build your Automated Valuation Models.

“To know more about data monetization read Ethics Data Monetization”

The next time you need to make a decision, base it on the data you have collected. To be a data-driven firm, you need a place to collect, store, and manage your data securely. You can do this with a Valuation Process Management Software like Evalo, which precisely enables you to collect and store data in your servers.

Learn more about "the most user-friendly system" by signing up for a free demo here.

Prevention is better than correction

evalo not only identifies and highlights errors but goes a step ahead and attempts to ensure the user enters only the correct data. Apart from breaking down complex activities into smaller sub activities, ![]() Match API highlights to the users the probable matches from the words and phrases used in the previous reports.

Match API highlights to the users the probable matches from the words and phrases used in the previous reports.

Minimise Risk - Maximise Profit

evalo is loaded with several features which minimise risk at multiple levels without complicating the process.

Dedupe

Littles escapes the most advanced 3 tier dedupe algorithm - ![]() Match API. The image match feature matches a new image will all the images in your existing data base and throws out probable matches to you.

Match API. The image match feature matches a new image will all the images in your existing data base and throws out probable matches to you.

Visit Duration

The time spent by a Valuer at site is a critical metric in quality assurance. More the time spent at site, better are the chances of getting detailed inputs on the property.

Unlock existing Wealth

Put your existing data to meaningful use by extracting distance based Valuation comparables.

Locational Intelligence

The ![]() GIS API fetches you the critical risk factors which have an potential impact over the property and its valuation.

GIS API fetches you the critical risk factors which have an potential impact over the property and its valuation.

Beginners highlight exceptions but experts handle them

Our powerful evalo Risk API automatically highlights exceptions associated with the property and leaving the decision making to Valuation Experts.

Designed to enhance end user experience

Each and every screen in both web and android app has been designed after understanding of the profiles of probable Users. In particular, we wanted to enhance convenience to both site visit engineer and Data entry user.